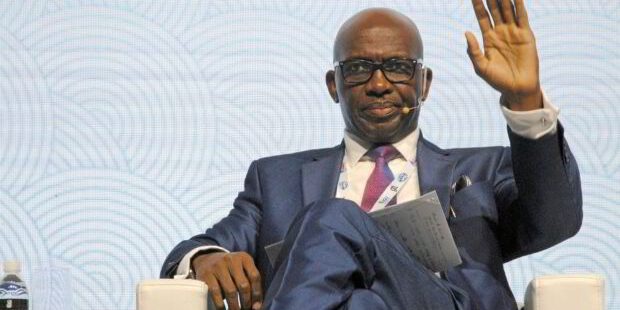

The former Managing Director of the Nigeria Liquefied Natural Gas (NLNG) Ltd has taken the helm of Renaissance Africa Energy Company, the consortium

The former Managing Director of the Nigeria Liquefied Natural Gas (NLNG) Ltd has taken the helm of Renaissance Africa Energy Company, the consortium of five companies which has just acquired Shell Petroleum Development Company (SPDC) of Nigeria.

Attah is the new Chief Executive and managing Director of the newly formed, incorporated consortium company, which expects to manage what used to be Shell’s 30% stake in the SPDC-JV comprising 18 Oil Mining Leases (OMLs) 20, 21, 22, 23, 25, 27, 28, 31, 32, 33, 35 36, 43, 45 and 46, all onshore, and OMLs 74, 77& 79, in shallow water, in the Niger Delta basin.

Attah retired from Shell only two years ago, precisely January 2022, after a career spanning over 30 years. He left the UK major five months after he stepped down from the NLNG Ltd at the end of August 2021, after having delivered on the most crucial item on his to -do -list; leading the company to a Final Investment Decision (FID) on Train 7, the seventh LNG Train in Bonny Island.

Attah has an impressive Cee Vee, and comes to the new job highly recommended. A mechanical engineer by training, he was previously Managing Director of Shell Nigeria Exploration Producing Company (SNEPCo), the Shell subsidiary which manages the upstream deepwater business. On his watch, the SNEPCo operated Bonga field, which is also Nigeria’s flagship deepwater hydrocarbon accumulation, was delivering over 150,000Barrels of Oil Per Day.

At the time he led NLNG Ltd to an FID on the incremental 8Million Metric Tonne Per Annum in 2019, he was the only CEO from an International Oil Company (IOC) background, working in Nigeria, who had delivered a project of that magnitude in the country in the five years before then. And going on five years after that decision, no project of that magnitude has seen an FID in Nigeria. Tony Attah took the reins of NLNG Ltd, nine years after the last Liquefaction Plant (Train 6) came on stream. Before him, two Chef Executives had worked to get Train 7 project off the ground, with some traction, but not visible success.

Attah’s experience in gas monetization will come in handy in the new job. The bulk of the feedstock for the NLNG (in which Shell holds a 25.6% stake) had always been sourced from the SPDC assets that Shell has just divested. The largest among them include Gbaran Ubie, Soku, Bonny (onshore), and EA (shallow water). These fields will now be operated by Renaissance.

Then again despite the sale of over 60% of its natural gas reserves in the country to Renaissance Africa Energy, Shell is still keen on playing the domestic gas market through Shell Nigeria Gas, its downstream gas distribution subsidiary while also focusing on clean energy via Day Star its recently acquired subsidiary which plays in the solar energy landscape.

Source: https://africaoilgasreport.com